Qitzur Shulchan Arukh – 65:15

In this way [through the selling of IOU contracts] one can make an arrangement; eg:

If Re’uvein needs money in Nissan, he goes to Shim’on, and Shim’on gives him an [IOU] contract on himself, that he promises to pay Re’uvein 100 gold coins in Tishrei. And against that, Re’uvein also gives a similar debt contract to Shim’on, that he promises to pay him 100 gold coins in Tishrei, so that Shim’on is insured [of being paid]. Then Re’uvein goes and sells the contract that he has on Shim’on [i.e. the side in which Shim’on pays him] to Levi now, in Nissan, for 90 gold coins.

All the more so, if Shim’on has a promissory note on Yehudah, whose payment date is not until later, which he can sell to Re’uvein [to be paid] in installements until it is due, and Reuven gives [Shim’on] a promissory note [in exchange] for this, and Re’uvein again sells this debt contract for whatever he can get.

However, if Reuven writes a debt contract on himself [to pay Shim’on at a later date] and sells this to Shim’on [at the current value of receiving the money later], even if thought an agent, this is prohibited.

Since interest is not so much a crime against the other as a lack of brotherliness, the rabbis were willing to permit utilizing loopholes that technically aren’t interest in cases where the overall goal of helping another Jew would be met. So, if our hypothetical Re’uvein needs money up front in Nissan and he can’t find someone who can afford to lend him the money without interest, we allow “financial engineering” to be used to accomplish something much like a loan.

We are presented with three cases. In all three it’s Nissan and Re’uvein needs money.

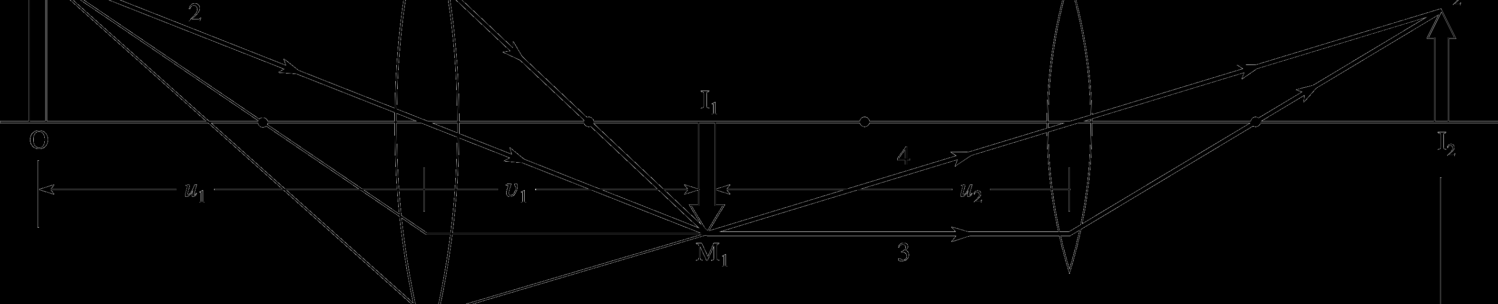

1- Re’uevein and Shim’on trade loan contracts of equal size — both are loans of 100 coins due in Tishrei. Shim’on isn’t risking anything, because the contracts net out to zero. But Re’uvein takes the contract he’s holding and sells it for 90 gold to Levi. So:

Re’uvein has 90 coins now, when he needs them. Come Tishrei he will have to pay Shim’on that debt back for 100 coins, and Shim’on’s debt will at the same time be repaid to the contract’s new holder, Levi. Total money flow is 90 coins from Levi to Re’uvein today, and 100 coins from Re’uvein to Levi in 6 months (the latter being paid via Shim’on).

2- Shim’on already has a loan owed him by Yehudah. He sells the contract to Re’uvein for Re’uvein to pay in installments. Shim’on gets a contract to this effect from Re’uvein. Meanwhile, Re’uvein resells Yehudah’s debt to a fourth party for payment up front.

Yehudah will pay the fourth party, so his debt is unchanged.

Shim’on receives installments from Re’uvein instead of being paid later by Yehudah. He is getting his money earlier (but it’s likely he’ll settle for slightly less total money in exchange).

Re’uvein receives money up front, when he needs it, from this unnamed fourth party. He ends up paying back more to Shim’on in those installments than he can get for the contract today.

3- What Re’uvein may not do is simply write a promissory note for 100 coins to be paid in Nissan to Shim’on and then sell it to Shim’on for 90 coins today. That, like the case we had earlier of commodity speculation, may not be technically interest, but it is a prohibited increase.

Recent Comments